More Malaysians saving RM500 monthly, with women leading the way

The survey, which involved 3,390 respondents nationwide, found that 28 per cent of Malaysian women now save more than RM500 monthly, up from 25 per cent last year.

KUALA LUMPUR – A survey has revealed a growing trend of Malaysians saving at least RM500 a month, with women showing the most significant improvements in financial well-being.

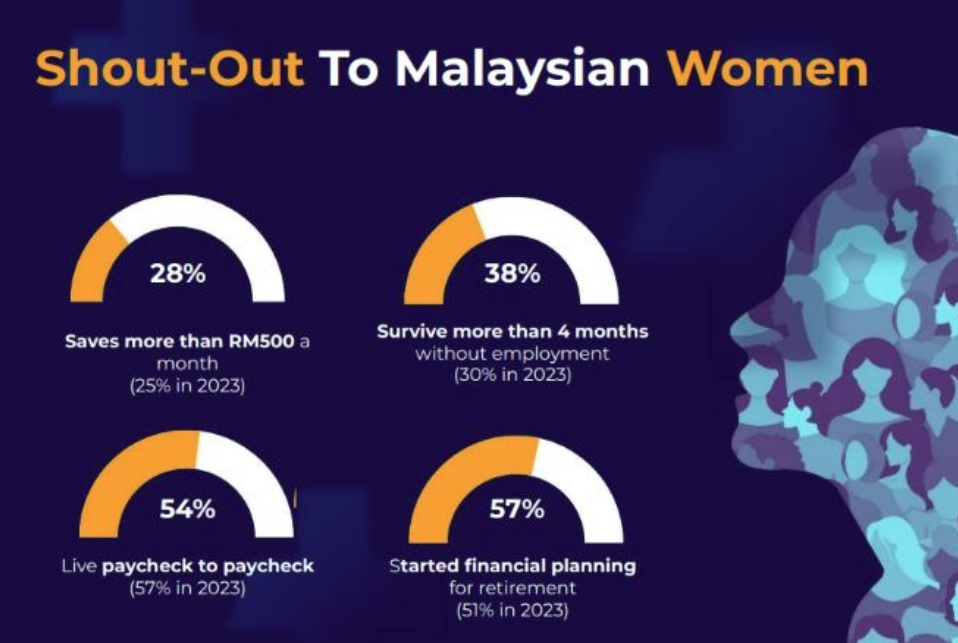

The 2024 Malaysian Financial Literacy Survey, which involved 3,390 respondents nationwide, found that 28 per cent of Malaysian women now save more than RM500 monthly, up from 25 per cent last year.

RinggitPlus chief executive officer Yuen Tuck Siew pointed out that more Malaysians were becoming better prepared for financial uncertainties.

“Looking at Malaysians who save more than RM500 a month, that has increased to 33 per cent of respondents, up from 29 per cent in 2023.

“Additionally, 39 per cent of our respondents said they could survive for four months or more without income, which is a significant jump from 33 per cent in 2023," Yuen said during the unveiling of the survey results at Menara Etiqa, Bangsar.

This annual study provides insights into the financial habits, challenges, and outlook of Malaysians. The 2024 survey gathered responses those aged 18 and above, ensuring a balanced representation across gender, race, age, and location for reliable data.

The results highlight improvements in key areas such as financial security, while also highlighting the need for enhanced digital financial literacy across the nation.

Among the event's attendees were PayNet Malaysia Chief Marketing Officer Gary Yeoh, FWD Chief Marketing Officer Susan Ong, CTOS Community Outreach and Events Manager Noor Hazwani Mohamad Noor and Alliance Bank’s Consumer Banking Head Gan Pai Li.

Yuen also pointed out that 47 per cent of Malaysians reported an improvement in their financial situation compared to 44 per cent in 2023.

This improvement has been driven by cost-cutting measures, such as eating out and leisure activities and greater focus on retirement planning.

“60 per cent of Malaysians have started planning for their financial future, compared to 54 per cent last year," Yuen added.

The report also highlighted the remarkable progress made by Malaysian women.

In 2023, women generally lagged behind men in terms of financial preparedness.

However, in 2024, women have shown improvement across key metrics.

"We were happy to see that 38 per cent of Malaysian women can now survive without a job for four months or more, a notable increase from 30 per cent in 2023," Yuen stated.

Additionally, 57 percent of women have started planning for retirement, compared to 51 per cent last year.

Although 54 per cent of women were still living paycheck to paycheck, this was an improvement from 57 percent in 2023.

Meanwhile, FWD Insurance Berhad chief marketing officer Susan Ong Char Kwee, expressed optimism about these developments, particularly in women’s financial independence.

"I am truly heartened by the results showing that women are becoming more financially independent.

“Over the past 12 months, factors such as an increase in women's workforce participation and rising education levels have contributed to their empowerment and financial planning,” she said during the panel discussions on Thursday.

Susan also discussed the importance of insurance protection, emphasising that it was a necessity for everyone, regardless of gender.

“Each individual, male or female, has unique financial needs. Planning for insurance protection requires awareness of one’s responsibilities and dependents.

“With digital platforms making information more accessible, 29 per cent of Malaysians now consider purchasing insurance online, and this trend is expected to grow," she said.

Both Ong and Yuen highlighted the increasing role of financial literacy programs in helping Malaysians take control of their financial futures.

With more accessible digital platforms, they said people were able to easily compare insurance options and plan for unforeseen circumstances.