72 per cent consumers worry about being fooled by deepfakes

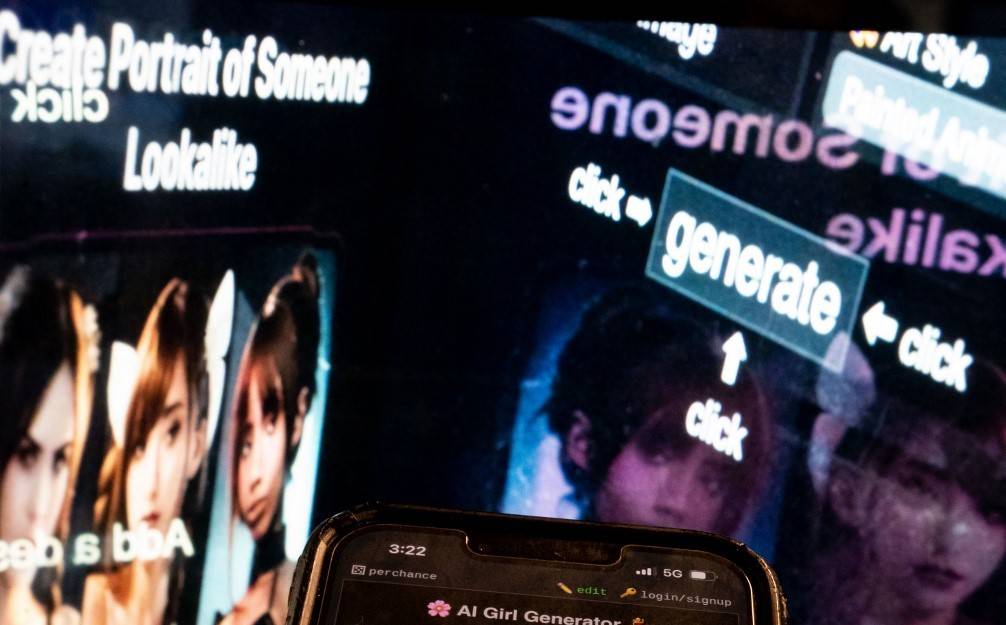

It highlight significant concerns among consumers about the risks associated with GenAI and deepfakes.

KUALA LUMPUR - A new research from Jumio revealed that nearly three-quarters of consumers (72 per cent) worry on a day-to-day basis about being fooled by a deepfake into handing over sensitive information or money, and only 15 per cent have never encountered a deepfake video, audio or image before.

According to Jumio in a statement, this year’s results highlight significant concerns among consumers about the risks associated with generative artificial intelligence (GenAI) and deepfakes, including the potential for increased cybercrime and identity fraud.

The third installment of its annual global consumer research conducted by Censuswide examined the views of 8,077 adult consumers, split evenly across the United Kingdom (UK), United States (US), Singapore and Mexico, that took place between March 25 and April 2.

The Jumio 2024 Online Identity Study found that even with high anxiety around this increasingly prevalent and ever-evolving technology, consumers continue to overestimate their ability to spot deepfakes, with 60 per cent believed they could detect a deepfake, up from 52 per cent in 2023.

Globally, men were more confident in their ability to spot a deepfake (66 per cent men versus 55 per cent women), with men aged between 18 to 34 demonstrating the most confidence (75 per cent), while women aged between 35 to 54 were least confident (52 per cent).

Although a significant majority (60 per cent) of consumers call for more governmental regulation of AI to address these issues, regulatory trust varies globally, with 69 per cent of Singaporeans expressing trust in their government’s ability to regulate AI, compared to just 26 per cent in the UK, 31 per cent in the US and 44 per cent in Mexico.

Fraud is an all-too-familiar issue for many consumers globally, with 68 per cent of respondents reporting that they know or suspect that they have been a victim of online fraud or identity theft, or that they know someone who has been affected.

The study showed that one-third (32 per cent) of consumers who were or suspected they were a victim of online fraud said it caused significant problems and several hours of administrative work to resolve, and 14 per cent went as far as calling it a traumatic experience.

More than 70 per cent of consumers say they would spend more time on identity verification if those measures improved security in industries including financial services (77 per cent), healthcare (74 per cent), government (72 per cent), retail and eCommerce (72 per cent), as well as social media (71 per cent).

When creating a new online account, global consumers said taking a picture of their ID and a live selfie would be the most accurate form of identity verification (21 per cent), with creating a secure password coming in at a close second (19 per cent). - BERNAMA