RM1.4 billion loan facility for hawkers, small traders can adress "Ah Long" problems

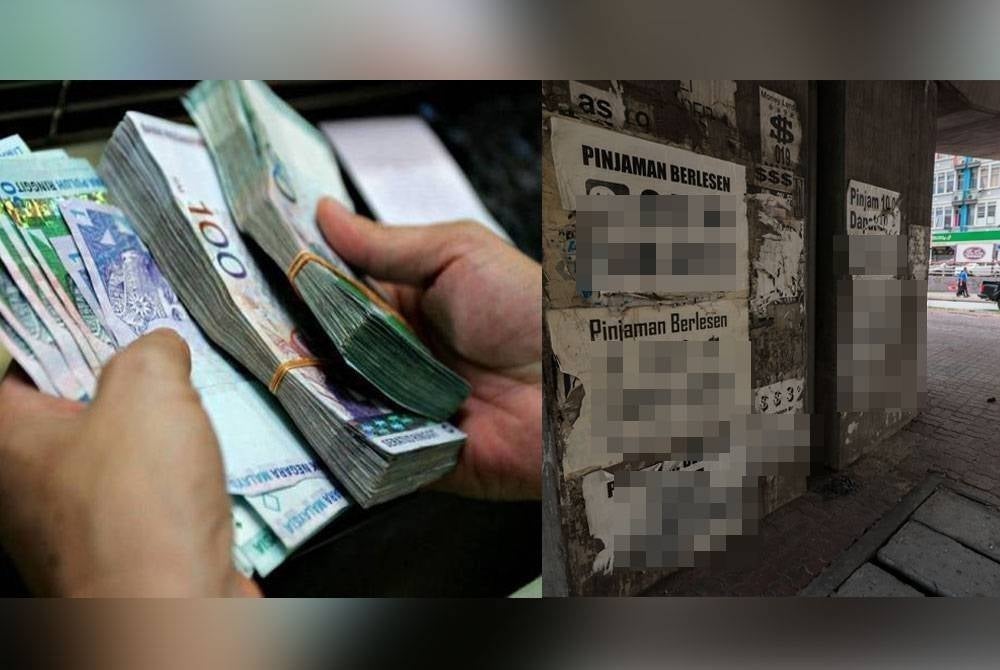

KUALA LUMPUR - Bank Simpanan Nasional's (BSN) micro financing loan facilities of RM1.4 billion to hawkers and small traders through Budget 2024 is able to prevent them from going to the "Ah Long” (loan sharks) or illegal money lenders.

Dean of the School of Business and Economics at Universiti Putra Malaysia, Prof Dr Bany Ariffin Amin Noordin said in most cases, hawkers resorted to Ah Long because they needed funds as capital to start or expand their business.

"For example, opening a business requires capital and for them (hawkers) to go to banks to apply for loans, it will be a problem to meet the conditions as they may not have a bank record, with low income, and some not highly educated. Hence, they end up going to Ah Long.

"Although it is easy to get loans from A Long, as the process is free and fast, the risk is high. On the other hand, with the BSN loan facility, it will be a two-pronged solution, as while it enables hawkers to start business easily, it will also prevent them from falling prey to Ah Long," he told Bernama.

Prime Minister Datuk Seri Anwar Ibrahim when tabling Budget 2024 in the Dewan Rakyat last Friday announced that a total of RM1.4 billion was provided under the BSN micro financing loan facilities for hawkers and small entrepreneurs to use as their business capital.

Bany Ariffin said the number of hawkers has mushroomed and attributed it to the many people having ventured into business as their source of income after being laid from their jobs.

Associate Prof Dr Azwan Abdullah from the Institute for Research and Poverty Management, Universiti Malaysia Kelantan, said the RM40 million allocation for the implementation of the Shop Malaysia Online Programme, especially for small traders in the food sector, would save the cost of not having to fork out rental for premises to carry out their business.

"Ten years ago, if you wanted to do business, you had to rent a shop and that required additional costs, but with the convenience of technology, it is no longer necessary to have a place to carry out business, because it can be done from home.

"So, this initiative is in line with the gig economy which is directly able to empower the family economy and improve the social standard of community life," he said. - BERNAMA