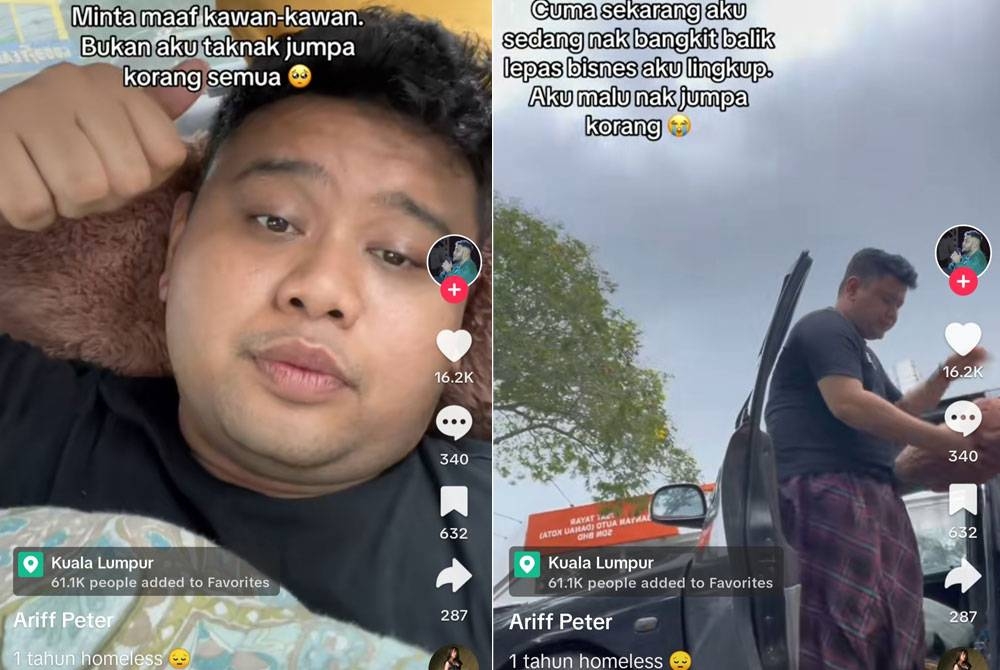

Man lives in a car, uses 90 per cent of salary to pay off RM1 million debt

KUALA LUMPUR - A man is not only forced to live in his car for the past year but also uses 90 per cent of his salary to pay off debt.

This is the horrendous ordeal faced by Ariff Luqman Peter Lisut, 27, who is burdened with a RM1 million debt after being influenced by digital currency investments in 2019.

The Sarawakian said he had learned about the investment scheme from his father when a company was looking for people to be product ambassadors.

Initially, the investment brought substantial returns before he faced a problem a year ago that changed his luxurious lifestyle in a blink of an eye.

"I had to sell all my assets to pay off the debt. I took on various jobs to gradually repay the debt, and now there's still RM100,000 left.

"With a steady job as the marketing head of a financial consulting company, I use 90 per cent of my RM6,000 salary to pay off the debt," he told Sinar today.

Ariff had previously shared about his life in which he is forced him to sleep in his car as he could not afford to rent a house due to the hefty debt.

He said he doesn't only rely on his regular job but also takes on side jobs such as cleaning services, poster advertising, and marketing to supplement his income and accelerate debt repayment.

He set a goal to clear the debt as quickly as possible to start a new life.

"I'm not being arrogant by refusing help or donations, but as a healthy man, I want to make the effort on my own accord.

"Some offer to provide housing or a rented room, but I politely declined because I'm more comfortable sleeping in my car, which makes it easier for me to get to work and do side jobs," he said.

He added that the Proton Wira he uses is the first car he ever bought and has been very helpful to him.

"Before this, I used another imported car but had to sell it to settle the debt. Although some people look at me negatively, I'm grateful that many have shown positive support for me since my life story went viral.

"When I first fell, I felt pressured, but now I'm more at ease, and my focus is solely on paying off the debt before I can finally breathe easy," he said.

Ariff said that his fate has been considered a valuable experience in life that has matured him and made him stronger to face challenges.

"My message to the public, especially young people, is not to easily trust others. You need to investigate and be cautious to avoid being deceived.

"Secondly, never take the easy way out. Every decision you make should have a plan, and you should be prepared for the consequences of your choices," he said.