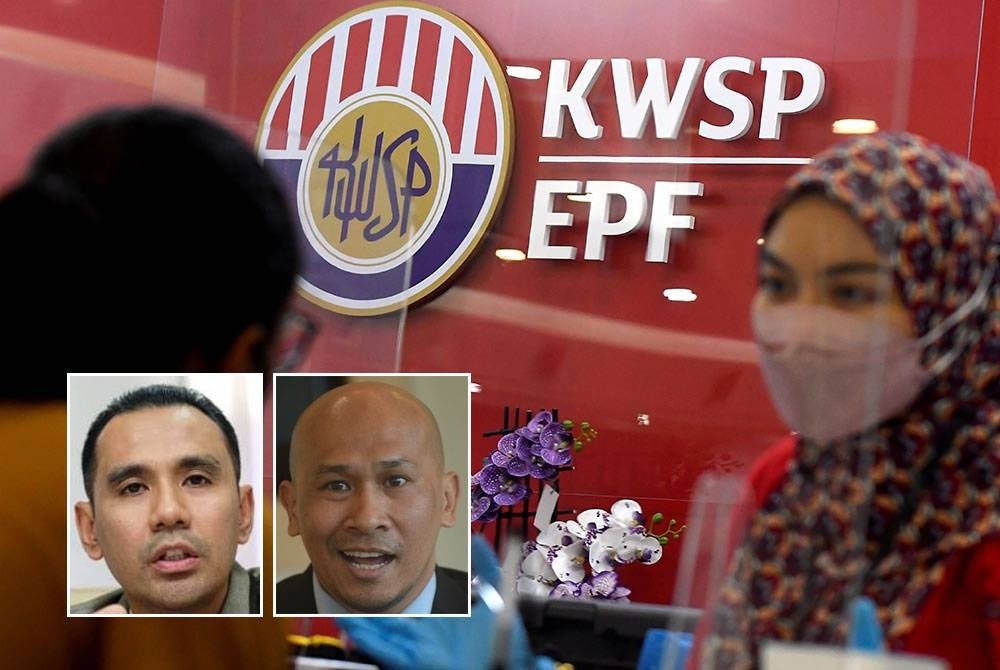

Risks failing to repay loans on EPF, warn experts

SHAH ALAM - The Employees Provident Fund's (EPF) steps in allowing members to apply for bank loans starting on Friday will provide relief for contributors for Eid in two weeks.

Many were hoping for immediate approval however, some were waiting for the special EPF withdrawals with Eid bringing high costs in buying new clothes and necessities.

Bank Muamalat Malaysia Bhd Social Economics and Finance chief Dr Mohd Afzanizam Abdul Rashid reminded contributors remain at risk if the Account 2 Support Facility (FSA2) loan is not paid.

"This facility is more towards providing contributors access to gain financing from institutions and the funds will become a collateral for their retirement funds.

"This step could provide some breathing room in terms of financial needs and cash in hand for them. However, the risks still remain as they could default in payments.

"They must know the risk they are putting themselves through if it is not repaid within the allotted period," he told reporters after the Bank Negara Malaysia Govenor Yearly Speech at the Malaysian Economic Forum organised by the Malaysian Economic Association in Kuala Lumpur on Monday.

Consumer finance expert Professor Dr Mohamad Fazli Sabri said EPF should detail the calculation of what bank loan is eligible based of the second account's balance.

"Even though it has a lower interest rate compared to other banks EPF must detail the total a contributor is eligible for to ease their calculations.

"For example, if their second account shows RM3,000 the loan they are eligible for should be based on it. This could be in the form of twice or three times the amount," he told Sinar on Monday.

The Universiti Putra Malaysia (UPM) Human Ecology Faculty Dean viewed EPF should explain alternatives for contributors if they could not afford such repayments.

"Alternatives must be explained to contributors that are unable to pay. We can't place the assumption all individuals can make their payments (within the stipulated period)," he said.

He suggested EPF to declare incentives such as rebates for borrowers completing loans in less than the stipulated period.

Fazli reminded contributors to make the smart choice towards this opportunity given by the government by taking into account their needs before applying for the loan.