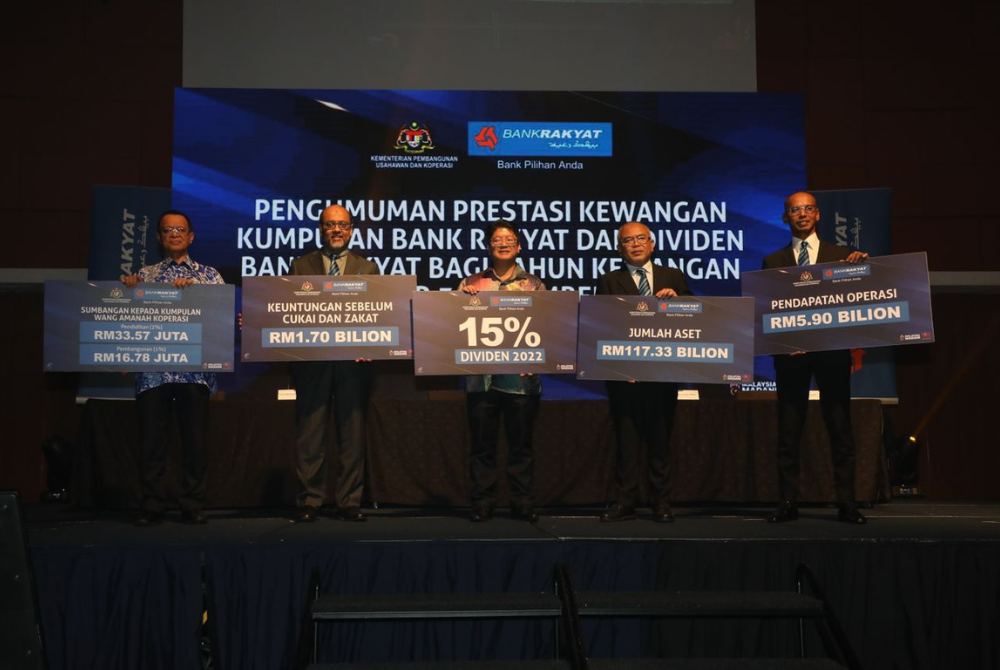

Bank Rakyat Group records FY22 profit of RM1.7 billion

KUALA LUMPUR – Bank Rakyat Group (the Group) announced a commendable performance for financial year ended 2022. The Group recorded higher profit before tax and zakat (PBTZ) of RM1.70 billion as compared to RM1.63 billion in the previous year.

The higher PBTZ was achieved through the Group’s strong fundamentals and focus on core activities amid the economic uncertainties from the post-pandemic.

The financial year 2022 result was helped by the Group’s financing and investment activities, reflecting the strength and resilience that the Group has developed in recent years. In addition, the adequate provisioning during the year, in line with the industry trend has also boosted the Group’s performance.

The Group’s core operating income rose 3.42 per cent to RM5.90 billion as compared to RM5.71 billion previously as a result of stronger financing growth both in Retail and Business financing segment coupled with the Overnight Policy Rate (OPR) movement.

The Group’s better performance was further supported by higher fee-based income and collection from charge-off financing recovery which improved by 24.10 per cent to RM440.79 million from RM355.19 million previously.

The Group demonstrated discipline and efficiency in cost management, which were reflected in its healthy cost to income ratio of 39.79 per cent, much lower than industry average of 44.20 per cent.

The Group continued to be competitive and profitable during the year and remained one of the largest full-fledged Islamic financial institution in Malaysia.

Asset Growth

The Group’s total assets grew 1.98 per cent or RM2.27 billion to RM117.33 billion, compared to RM115.06 billion in the preceding financial year. The continuous growth momentum was mainly driven by positive traction in gross financing and supported by net growth in treasury assets, corresponding with the Group’s strategy throughout the year.

Return on Assets (ROA) improved to 1.45 per cent from 1.40 per cent in line with the industry trend.

Stable Financing Balance

Gross financing balance grew 1.04 per cent to RM80.44 billion from RM79.62 billion in the previous financial year. Despite intense competition post-pandemic, the Group continued to benefit from the diversification of portfolios, mainly from Home, Vehicle and Business Financing.

As a result of the diversification, the Group’s financing Retail segment grew by 0.10 per cent to RM73.41 billion and Business segment posted solid growth of 14.52 per cent to RM7.02 billion.

The Group’s assets quality remained sound with gross impaired financing ratio recorded at 1.98 per cent as compared to 1.70 per cent previously.

At the same time, Financing Loss Coverage ratio remained high at 192.51% as compared to 196.70% previously, well above the industry average of 98.20 per cent.

Stable Deposit Balances

The Group’s CASA increased by 2.84 per cent to RM9.49 billion as compared to RM9.23 billion previously resulted from the aggressive cash management activities as well as the continuous promotions throughout the year.

CASA ratio remained stable at 11.14 per cent aligned with the Group’s 5 years strategic plan aspiration (BR25).

Strong Capital Position

The Group’s shareholders fund increased by 4.15 per cent or RM0.89 billion to RM22.55 billion compared to RM21.66 billion in prior year contributed by the Group’s net profit carried forward during the year.

As at Dec 31 2022, Risk-Weighted Capital Ratio and Core Capital Ratio after the proposed final dividend remained strong at 27.58 per cent and 25 per cent respectively, well above the minimum regulatory requirements and the industry average, positioning the Group as one of the strongest financial institutions in terms of capital position.

Conclusion

The Group will continue to focus on its mandated role as well as the new growth areas, to create long-term value to members.

The Group has made good headway in our BR25 journey in 2022. The exciting Phase 3 of BR25 will focus on execution and implementation of key deliverables in the six established blueprints namely Great Customer Experience, Digitalisation, Business Banking Centre, Human Capital, Sustainability and Shariah Leadership.

The Group also welcomes the public to patronise our 148 branches, 27 Ar-Rahnu X’Change outlets, 4 Rakyat Xcess outlets, 21 Rakyat Xcess and Ar-Rahnu X’Change outlets, 261 Rakyat C.A.R.E, as well as 987 automated teller machines (ATM), cash deposit machines (CDM) and cash-in cash-out machines (CICO).

In addition, the public may also benefit from the Group’s integrated call centre, tele-Rakyat 1-300-80-5454 as well as our online internet banking services at www.irakyat.com.my and iRakyat mobile banking app for day-to-day banking transactions.