EPF expects optimum returns for syariah savings after separating from conventional savings

04 Mar 2023 07:01pm

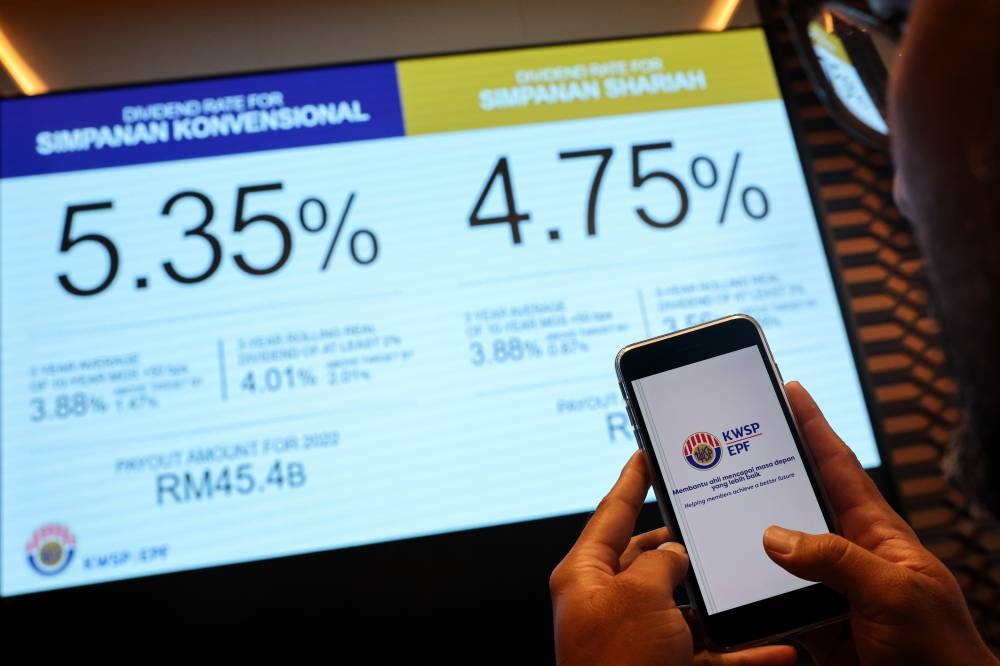

The EPF Board today announced a dividend rate of 5.35% for Simpanan Konvensional, with a total payout of RM45.44 billion and 4.75% for Simpanan Syariah with a total payout of RM 5.70 billion bringing the total payout amount for 2022 to RM 51.14 billion - BERNAMA

EPF chief executive officer Datuk Seri Amir Hamzah Azizan said since syariah savings had been introduced in 2017, the provident fund has been working to improve the current business model by completely separating shariah savings assets from investing together with syariah-compliant assets in conventional savings.

"With this separation, syariah savings will have its own strategic opportunity and strategic asset allocation that is different from conventional savings.

"This can ensure that both syariah savings and conventional savings have a more optimal, competitive and sustainable long-term return,” he said at a press conference after the EPF’s financial performance briefing here today.

Amir Hamzah said the separation of syariah savings assets from conventional savings assets will be launched on Jan 1, 2024, as stated in last month’s announcement of Budget 2023.

He said the separation allows the EPF to set a percentage limit for each desired investment, and not because investments in syariah savings are not halal.

However, he said that the returns obtained need to look at the current economic situation, whether domestic or overseas.

"For example, if the stock market goes up a lot, the overall returns will go up, and this will allow us to give high returns, but from what we saw last year, the stock market did not perform, and the EPF has to deal with that issue.

"So, in terms of the portfolio, we have to be good at balancing it, if one investment portfolio goes down, while the other survives, then we can stabilise (returns),” he explained.

Amir Hamzah also expects the investment situation in 2023 to continue to be challenging in the short and medium term.

He said this ongoing uncertainty, at the same time, emphasises the need to build resilience in line with the EPF’s long-term investment objectives and strategic asset allocation.

He added that Budget 2023 emphasised efforts to strengthen the recovery and resilience of the country’s economy.

On other developments, Amir Hamzah said EPF will be announcing the increase of the voluntary contribution limit to RM100,000 in April this year.

"In the previous Budget 2023, which was announced by the former finance minister, an increase of voluntary contribution limit from RM60,000 to RM100,000, was stated but, unfortunately, the budget was not gazetted yet so we would not be able to roll it out.

"But we have received the board’s support that directionally, RM100,000 is the right number and we are now working on a process to legitimise the lifting of that amount,” he added - BERNAMA