Govt unveils RM372 billion budget, big chunk goes to Finance Ministry

SINAR DAILY TEAM

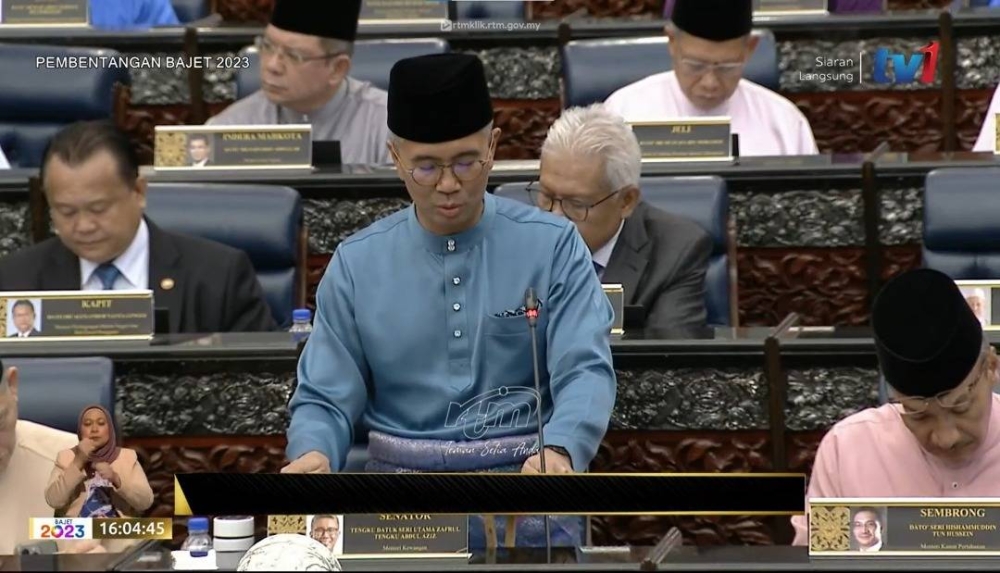

KUALA LUMPUR - Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz has tabled the 2023 Budget at the Dewan Rakyat, unveiling a RM372 billion allocation.

A total of RM272 billion has been allocated for operational expenditure, RM95 billion of which were for development and RM5 billion for the Covid-19 fund.

Two hundred discussions were held with stakeholders with 12,000 feedbacks received for the budget.

With the world geo-political conflict, he said the country needed to be prepared with the world development adding that the 2023 global economy remained the challenge with slow economic developments.

The country’s growth in 2023 was expected to grow moderately, at about four to five per cent, he added.

The top three recipients of the 2023 Budget were the Finance Ministry (RM72.2 billion), Education Ministry (RM55.6 billion) and Health Ministry (RM36.1 billion), representing 43.3 per cent of the total expenditure.

"The budget is for all. It is a budget based on "Keluarga Malaysia"," he said.

Here are the highlights of 2023 Budget:

SOCIAL WELFARE

- RM2.5 billion for monthly welfare projects involving 450,000 households.

- Electric power subsidy of up to RM40 for hardcore poor under e-Kasih.

- Poverty Line Income had been been increased from RM980 to RM1,169.

- Those with household income lower than RM2,500 and with less than five children will be entitled to a RM1,000 - RM2,000 Keluarga Malaysia Aid.

- Bachelors, senior citizens and married couples with no children to receive RM500 Keluarga Malaysia Aid.

- Additional RM500 aid for single mothers or fathers to continue. This means that this group will receive up to RM3,000 as compared to RM2,500, this year.

- Keluarga Malaysia aid to benefit 8.7 million people with an allocation of RM7.8 million.

- A total of RM10 billion has been allocated for the Welfare Department’s monthly aid and the Keluarga Malaysia Aid.

- RM 1 billion has been allocated for the Keluarga Malaysia Hardcore Poor Eradication Programme.

- RM1 billion allocation for welfare of senior citizens.

- RM1.2 billion allocation for the Persons with Disabilities (PwDs) group.

TAX RELIEF

- Two percentage points cut on taxable income ranging from RM50,000 to RM100,000 for domiciled individuals.

- For those with monthly earnings of RM70.000 to RM100,000 to enjoy two per cent tax deduction.

- Tax savings of up to RM1,000 for middle income group, RM250 for high income group.

- Tax cuts from 13 per cent to 11 per cent for those who earn between RM50,000 to RM70,000.

- EPF voluntary contribution limit will be increased to RM100,000 per year compared to the previous RM60,000.

- Tax relief of childcare fees valued at RM3,000 will be extended until assessment year 2024.

- Government proposes further tax incentives for intellectual property development until Dec 31, 2025.

HEALTH FOR WOMEN

- A total of RM235 million has been allocated under the Women’s Special Financial Fund for their entreprenurial endeavors

- Government allocates RM11 million subsidy for cervix cancer and mammogram screenings.

CAREER BREAK

- Women who return to work after a career break will be exempted from tax from 2023 to 2028.

MANDATORY SOCIAL SECURITY CONTRIBUTION

- Government to make Socso contribution SKSPS mandatory for all self-employed sectors in stages.

-Total holding limit for ASB and ASB2 to be increased to RM300,000 compared to the previous RM200,000.

TRANSPORTATION

- Government to shoulder licensing payment for taxis, buses, e-hailing operators.

- Government to pay test fee for B2 test licence.

- Tekun Mobileprenuer scheme to get a boost of RM10 million.

- BSN to prepare easy loan funds to help B40 invest in ASB.

- My50 monthly pass to continue, expected to benefit 180,000 commuters.

- The Pan Borneo Highway is expected to be fully completed by 2024.

- MRT Phase 2 expected to be operational in January 2023.

- MRT3 Phase 1 expected to be completed in 2028. Phase 2 in 2030.

TEENAGERS

- Internet aid of RM30 for three months until April 2023.

- E-Pemula to continue for two million youths between the age of 18 and 20 and for full-time students who are 21 years old.

MENTAL HEALTH

- RM8 million provided to strengthen local social support centres to deal with mental health and domestic violence issues.

FOOD SECURITY

- Farmers and fishermen to enjoy a total of RM1.8 billion subsidies involving padi fertilisers, padi seedlings and other output incentives and incentive for catchments.

- Padi farmers to recieve three-month cash aid of RM300, covering 240,000 recipients.

HOUSEBUYERS

- A 75 per cent exemption on purchase of RM750,000 houses to save buyers up to RM15,000.

- A 100 per cent exemption on purchase of houses worth RM300,000 to save buyers RM6,500.

BENEFITS FOR EMPLOYERS

- Bosses who employ unemployed youths for more than three months aged 18 to 30 are given employment incentives under Perkeso.

SMEs

- One-off grants will be given to registered micro-small enterprises, totalling RM1 billion.

- Bank Negara to provide RM10 billion for automation and digitalisation of SMEs.

- PUNB to allocate RM200 million for Bumiputera retail and trade.

- 100 per cent stamp duty exception for restructuring agreement and rescheduling and payment of loan till 2024.

MITRA

- Mitra to get RM100 million for entrepreneurnial development.

SUBSIDIES

- Government allocates over RM55 billion for subsidies, aid and incentives to uplift cost of living.

TOURISM

- A total of RM200 million will be allocated for promotional and marketing of the country’s tourism.

- RM90 million matching grants under Gamelan initiatives.

- To boost domestic tourism, Malaysians to enjoy RM100 vouchers and rebates for accommodation, holiday packages.

GOVERNANCE

- Government to introduce Fiscal Responsibility Act to increase accountability fiscal management. (Various discussions were held with stakeholders. The bill to be tabled during this parliamentary sitting).

INCOME TAX

- Starting 2023 Malaysians aged 18 and above and also its permanent residents will automatically recieve a Tax Identificatiom Number (TIN). TIN will be compulsory for document stamping and other relevant documents.

VICE ACTIVITIES

- Stringent import control in cigarettes and liquor including at private jetties. Transhipment of liquor will be limited at certain ports.

- Bukit Kayu Hitam will be the single entry point for the northern region.

CROWDFUNDING

- Government to provide Malaysia Co-investment Fund (MyCIF) of RM30 million in addition to the equity crowdfunding fund (ECF).

SOCIAL WELFARE

- RM150 million for Social Welfare Employment Incentive, expected to open up career opportunities for more than 70 thousand job seekers.

HEALTH

- RM80 million subsidies for diabetes screening for PEKA B40.

MySALAM

- The MySalam government insurance scheme to continue for 2023.

GDP

- Country's deficit level for 2023 to 2025 to decrease with an average of 4.4 per cent.

AGROFOOD

- BNM’s Agrofood Financing Scheme to receive RM1 billion to help entrepreneurs increase food productivity.

UTC

- Government through MDEC to transform UTC as a digital hub.

CYBERSECURITY

- RM73 million allocated to enhance cybersecurity.

- Government to set up a national scam response centre.

FLASH FLOODS

- Nadma to receive RM174 million for flash floods.

- Weather forecast and flood warning systems to be fortified.

PTPTN

- 15 to 20 per cent discount for PTPTN loan borrowers from Nov 1, 2022 to April 30, 2023.

AID FOR CIVIL SERVANTS

- Aidilfitri aid for civil servants increased to RM600.

- RM350 one-off aid for one million retired civil servants.

- One-off RM700 special aid for 1.3 million civil servants under Grade 56.

- RM100 increment for all civil servants between Grade 11 and Grade 56.

- Special leave for over 500,000 teachers.

- RM100 subsidy for civil servants for insurance coverage.

CRADLE FUND

- Cradle Fund to provide allocation of RM50 million to help startups innovate internationally.

ORANG ASLI

- Orang Asli to get RM305 million under Budget 2023 for social aid and for uplifting living standards.

RELIGIOUS SCHOOLS, KAFA TEACHERS

- Jakim to receive RM150 million for maintenance of Tahfiz, registered pondok schools and public Islamic religious schools.

- One-off handout of RM500 to all Kafa teachers, Takmir, Imam, Bilal, Siak, Noja and Marbut.

RURAL SABAH SARAWAK (RM2.55 billion)

- RM1.5 billion for rural infrastructure such as roads.

- RM472 million for rural electrical infrastructure.

- RM381 million for water supplies and alternative resources supplies.

- RM123 million for rural roads lighting projects.

- RM54 million to build 85 bridges in rural areas.

CARBON TAX

-Government looks at introducing carbon tax. It is finalising mechanism on tax pricing.

- It is allocating RM10 million to matching grants to help SMEs to reduce carbon footprint.