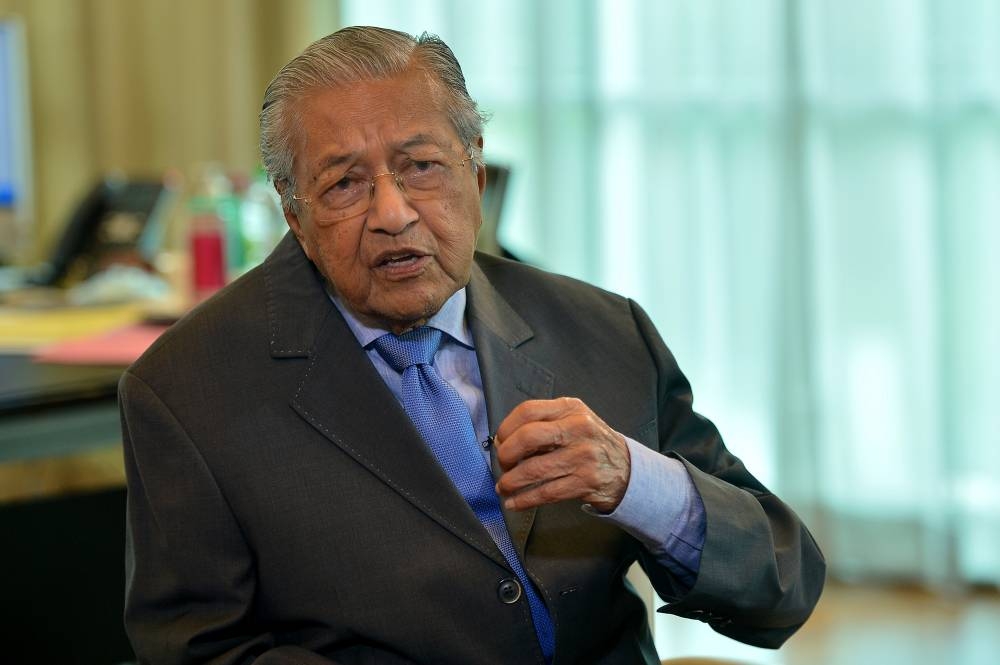

We're not like Sri Lanka - Peg ringgit, provide subsidies to overcome inflation, Dr M says

KHAIRIL ANWAR MOHD AMIN LIZA MOKHTAR

KUALA LUMPUR - The government’s best formula to overcome the inflation crisis is to peg Ringgit Malaysia (RM) in the market and implement massive subsidies for the people.

Two-time former prime minister Tun Dr Mahathir Mohamad said the government needed to take the initiative as shown by the United States (US) government during the US financial crisis in 2008 when they spent a massive amount of money to aid their people to cope with the rising cost of living.

The 97-year-old Langkawi MP, at the same time asked for the value of the RM currency to be redefined (tethered) by the government and no longer based on the open market determination.

“We previously saved our country and others when we set the exchange value at RM3.80 against the US dollar (in the 1998 Asian Financial Crisis). We were not only saved, but all other countries benefited from it.

“But now, we are not taking care of the value of our currency. When we don’t take care of it, some people deliberately devalue the ringgit, and we become poor as our purchasing power decreases.

“If the value of our currency falls, foreign investors will leave Malaysia since they incur a loss with the fall of our currency value. That’s why we’re seeing investors pulling out from the country,” he said in an exclusive interview with Sinar Premium at the Al-Bukhary Foundation building on Wednesday.

Dr Mahathir was commenting on the implications of the economic crisis and hyperinflation faced by Malaysia and the rest of the world at the moment, which led to more than 34 million Malaysians caught in the issue of the rising cost of living.

The Department of Statistics Malaysia (DOSM) previously released a statistical report on the Consumer Price Index (CPI) for May, which jumped to 2.8 per cent from 2.3 per cent in the previous month.

There was no doubt that the scenario of rising prices and costs of living were affecting Malaysian in particular, especially after 184 food items out of a total of 552 items in the CPI’ basket’ recorded an increase.

Commenting further, despite claims that the government was facing a shortage of funds to provide additional subsidies to the people, Dr Mahathir revealed that the country still has a high treasury reserve that accounted for 40 per cent of Malaysia’s Gross Domestic Product (GDP) value stored annually.

He explained that some of the government’s savings could be used to provide a subsidy for the people and would not be a liability for the country due to it being a treasury reserve.

“We may be able to make a (external) loan, but Malaysia is extraordinary, we have a high reserve that covers 40 per cent of Malaysia’s GDP saved every year. We have a lot of money.

“Some of the money can be used and it is not going to be a cost (liability) because the money is just savings.

“So, if we take 10 or 20 per cent of the savings, there will be no effects to our treasury reserves. Our savings are still huge and will strengthen our currency,” he said.

The Pejuang Chairman added that the government’s move to distribute large-scale subsidies to the people in times of crisis would not harm the government.

He said this because the money given to the people would be spent, sellers would benefit and the government would eventually gain the returns through corporate and business tax collections.

“This all requires a way for the government to handle the economic issues well. We need to help the people, provide subsidies where we can. Subsidies by the government will not bring it harm.

“If the government spends RM100 million for the people, maybe the collection from taxes would be up to RM50 million.

“We have to be efficient in the field of financial management. With this measure, the increase in the cost of living can be contained without affecting the country’s economy.

“This is due to Malaysia’s considerable treasury savings. We’re not like Sri Lanka where there is not a single penny of savings at all,” he said, adding that the Malaysian government could contribute to the subsidies of the people.