SHAH ALAM - The collapse of the the United States (US) bank namely Silicon Valley Bank (SVB) will only have a small impact on Malaysia even if it impacted the country's capital and banking markets.

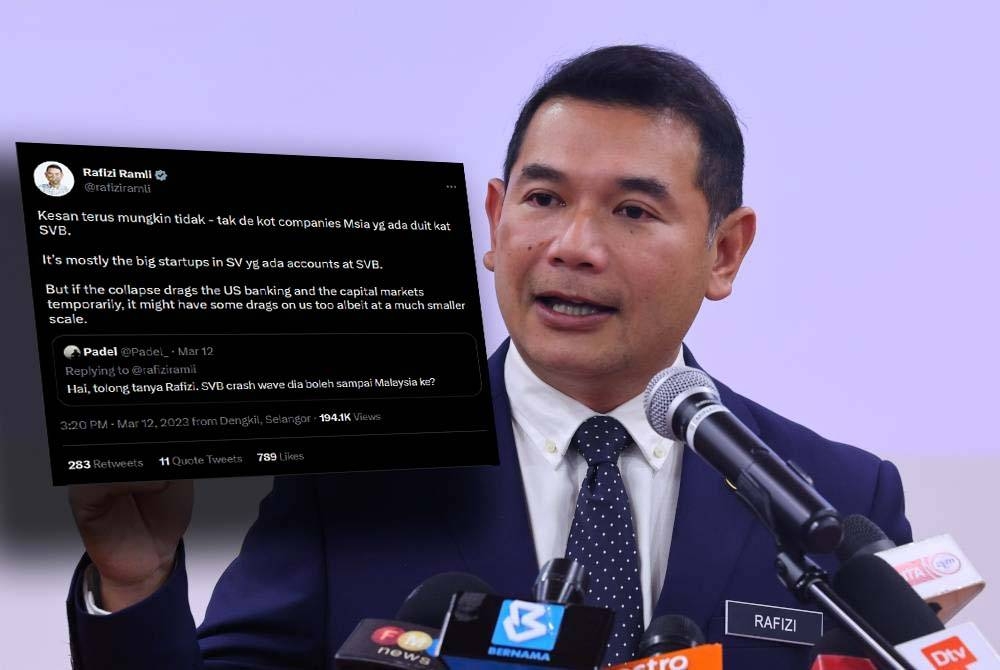

Economy Minister Rafizi Ramli explained that Malaysia may not experience direct impact from the SVB collapse since no local company has deposits in said bank.

"There might be no direct effect since no company in Malaysia has money stored in SVB. On average, only large startups companies in Silicon Valley have SVB accounts.

"But if the collapse drags down US banking and capital markets for a while then Malaysian will feel the fall, even on a small scale," he said via Twitter on Monday.

He said so in response to a comment after answering a question on issue of the 16th largest bank in the US which collapsed and claims on that it will affect the financial market in this country.

SVB is the largest retail bank to collapse since the 2008 financial crisis.

The bank's issues escalated after a year-long Federal Reserves (Fed) interest rate hike which meant that the securities SVB owned were sold at a significantly lower price, a problem other banks had likely faced.

The fall of SVB, which specialised in venture capital funding mainly in the technology sector, happened after depositors withdrew a large amount of their savings and it could no longer operate on its own.